Use the links above to get $250 AED when you sign up with either platform.

When it comes to investing in real estate, crowdfunding platforms have made it easier than ever before to get involved. With so many platforms to choose from, it can be overwhelming to decide which one is the best fit for your investment goals.

In this comparison blog, we will be looking at two popular crowdfunding platforms in Dubai – SmartCrowd and Stake – to help you make an informed decision. We will be analyzing the key features of each platform, including their fees, investment opportunities, user interface, customer service, and more.

By the end of this article, you will have a better understanding of the similarities and differences between SmartCrowd and Stake, allowing you to choose the platform that best suits your investment needs. So let’s dive in and see how these two platforms stack up against each other!

The following table of contents provides a structured outline of the article, which can be used to guide you through the different sections covered. You can click on any section to jump directly to that part of the article.

I. Definition and Significance of Real Estate Crowdfunding Platforms

II. How Real Estate Crowdfunding Works

III. Comparison of Leading Real Estate Crowdfunding Platforms: SmartCrowd vs Stake

- Fees and Costs

- User Experience and Reviews

- Transparency and Due Diligence

- Investment Options

- Analysis of the Profitability and Returns

IV. Conclusion

Real Estate Crowdfunding – Unlocking Access and Potential

What is Real Estate Crowdfunding?

Real estate crowdfunding platforms are online platforms that connect investors with real estate investment opportunities. Through these platforms, individuals can pool their financial resources with other investors to collectively invest in a wide range of real estate projects.

Unlike traditional real estate investing, which typically requires substantial capital and industry expertise, crowdfunding platforms enable investors of various financial means to participate in real estate ventures.

Why Real Estate Crowdfunding?

- Access to Real Estate Investments: Real estate has long been recognized as a stable and lucrative investment class. However, access to quality real estate deals has traditionally been limited to institutional investors or high-net-worth individuals. Real estate crowdfunding platforms democratize access to these opportunities, allowing individuals with lower capital thresholds to invest in properties they would otherwise be unable to access independently.

- Diversification and Risk Mitigation: Real estate crowdfunding platforms offer investors the ability to diversify their portfolios across different types of real estate assets, such as residential, commercial, and mixed-use properties. Diversification helps spread risk by reducing exposure to a single investment, property type, or geographic location. By participating in multiple real estate projects through crowdfunding, investors can potentially mitigate risk and enhance the stability of their investment portfolios.

- Transparency and Information: Real estate crowdfunding platforms prioritize transparency by providing investors with comprehensive information about the investment opportunities available. Investors can review detailed property information, financial projections, risk assessments, and other relevant data to make informed investment decisions. This transparency helps investors evaluate the potential risks and rewards associated with each investment, enhancing their ability to select projects that align with their investment goals and risk tolerance.

- Passive Income and Potential Returns: Real estate crowdfunding platforms enable investors to generate passive income through rental returns and potential capital appreciation. Investors can earn regular cash flows from rental income distributed by the platform, providing a steady stream of returns. Additionally, if the property appreciates in value over time, investors may benefit from capital gains when they exit their investment.

Real estate crowdfunding platforms have redefined the investment landscape by democratizing access to real estate investments, offering diversification opportunities, enhancing transparency, and providing potential income and returns.

By leveraging these platforms, investors can navigate the real estate market with greater ease and efficiency, expanding their investment portfolios and potentially reaping the rewards of this dynamic asset class.

How Real Estate Crowdfunding Works

This section will provide an overview of how real estate crowdfunding works, including the process involved and the key participants. Understanding the mechanics of real estate crowdfunding will enable investors to grasp the dynamics of this innovative investment approach.

Process of Real Estate Crowdfunding

A. Project Selection and Due Diligence

- Identification of potential real estate projects

- Evaluation of project viability and profitability

- Conducting thorough due diligence on selected projects

B. Platform Registration and Investor Onboarding

- Registration process for investors on the crowdfunding platform

- Verification and compliance procedures

- Completion of investor onboarding requirements

C. Project Listing and Documentation

- Developers or sponsors list their real estate projects on the platform

- Preparation of detailed project documentation, including financial projections, risk assessments, and legal documentation

- Presentation of investment opportunities to potential investors

D. Investor Participation and Funding

- Investors browse through available projects and review project details

- Investors select projects of interest and commit their investment amount

- Funding process, which may involve a minimum investment threshold or target amount to be reached

E. Investment Monitoring and Management

- Ongoing monitoring of the project’s progress by the crowdfunding platform

- Regular communication with investors, providing project updates and financial reports

- Platform’s role in managing distributions, rental income, and other financial aspects

Key Participants in Real Estate Crowdfunding

Investors

- Individual investors seeking to participate in real estate investments

- Range from retail investors to high-net-worth individuals

- Investors contribute capital and become fractional owners of the underlying real estate assets

Developers or Sponsors

- Real estate developers or sponsors who initiate the projects

- Responsible for identifying, acquiring, and managing the properties

- Collaborate with the crowdfunding platform to access capital from a larger investor base

Crowdfunding Platforms

- Online platforms that facilitate the crowdfunding process

- Provide a marketplace for connecting investors and real estate projects

- Offer tools for project selection, due diligence, investment tracking, and communication

Regulatory Authorities

- Regulators overseeing real estate crowdfunding activities

- Ensure compliance with securities laws and investor protection regulations

- Set guidelines and requirements for crowdfunding platforms and participants

Understanding the process and the roles of key participants in real estate crowdfunding lays the foundation for making informed investment decisions.

By comprehending how projects are selected, investors are onboarded, and investments are managed, individuals can navigate the real estate crowdfunding landscape with confidence, optimizing their investment strategies and potentially reaping the benefits of this dynamic investment approach.

Comparison of Leading Real Estate Crowdfunding Platforms: SmartCrowd vs Stake

Fees and Cost

Real estate crowdfunding platforms typically charge various fees that can impact an investor’s overall returns. These fees may include acquisition fees, performance fees, transaction fees, and other costs associated with the investment process.

By examining the fee structures of SmartCrowd and Stake, investors can gain insights into the financial implications of investing through these platforms.

To provide a concise and comparative overview of the fees and costs, we will present the information in a table format. The table will outline the different types of fees and costs associated with each platform, allowing investors to compare them side by side.

| Fees and Cost | SmartCrowd | Stake | |||||

|---|---|---|---|---|---|---|---|

| Entry Fee | One time fee of 1.5% on entry to each property investment. | One time fee of 1.5% on entry to each property investment. | |||||

| Exit Fee | 2.5% of the sale price if the property is sold before the end of the investment term | 2.5% of the sale price if the property is sold before the end of the investment term | |||||

| Administrative Fee | 0.5% to renew Investment vehicle *Only pay when you start earning returns on your investment | 0.5% yearly administration fee. *Calculated as a percentage of the investor’s account balance. | |||||

| Minimum Investment | 500 AED (136 USD) | 500 AED (136 USD) | |||||

| Know Your Customer and Anti-Money Laundering Fees | N/A -Already incorporated in the Entry Fee | 0.2% at the time of property acquisition and 0.1% annually starting from the second year of the Investment Term | |||||

By considering the fees and costs associated with SmartCrowd and Stake, investors can make informed decisions about which platform aligns better with their financial goals and investment preferences.

Evaluating the fee structures will enable investors to assess the potential impact on their returns, ensuring transparency and informed decision-making throughout their real estate crowdfunding journey.

User Experience and Reviews

The user experience is a crucial aspect of any real estate crowdfunding platform as it directly impacts investors’ ability to navigate the platform, access information, and make investment decisions.

Overall, a superior user experience in a real estate crowdfunding platform improves usability, accessibility, transparency, trust, and engagement. It creates a positive environment for investors to explore investment opportunities, make informed decisions, and manage their portfolios effectively, leading to a more satisfying and successful investment experience.

In this section, we will evaluate and compare the user experience provided by SmartCrowd and Stake, considering factors such as user interface, navigation, mobile app availability, and user reviews.

User Interface and Navigation

SmartCrowd

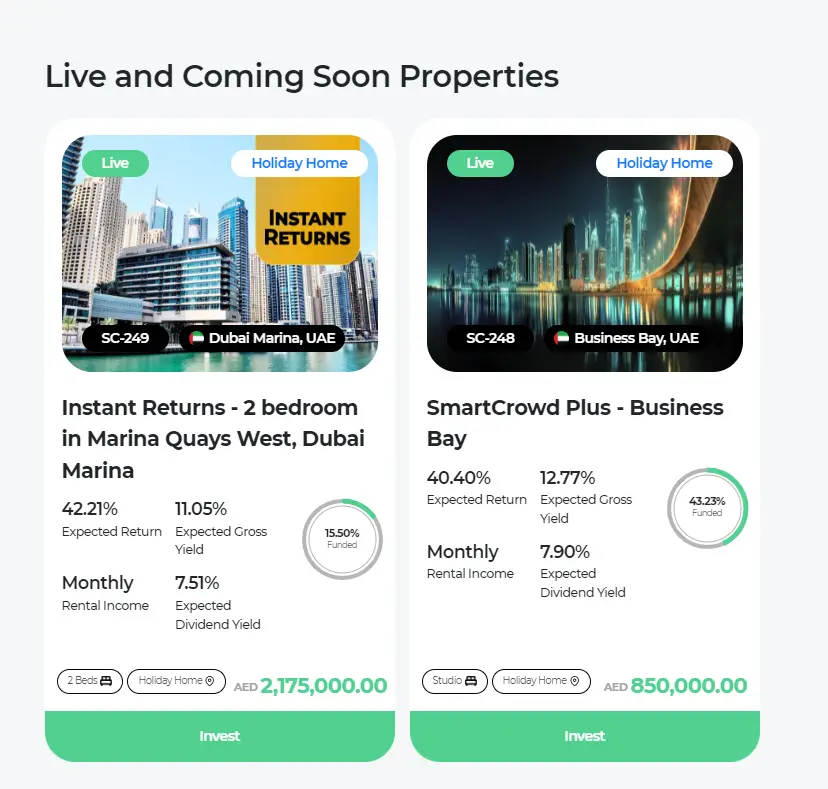

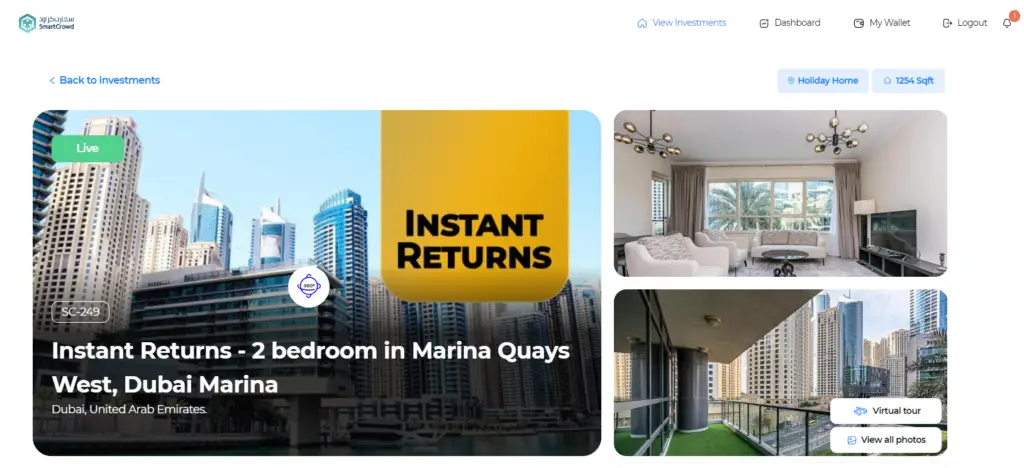

I. Browse Properties

II. Property Overview

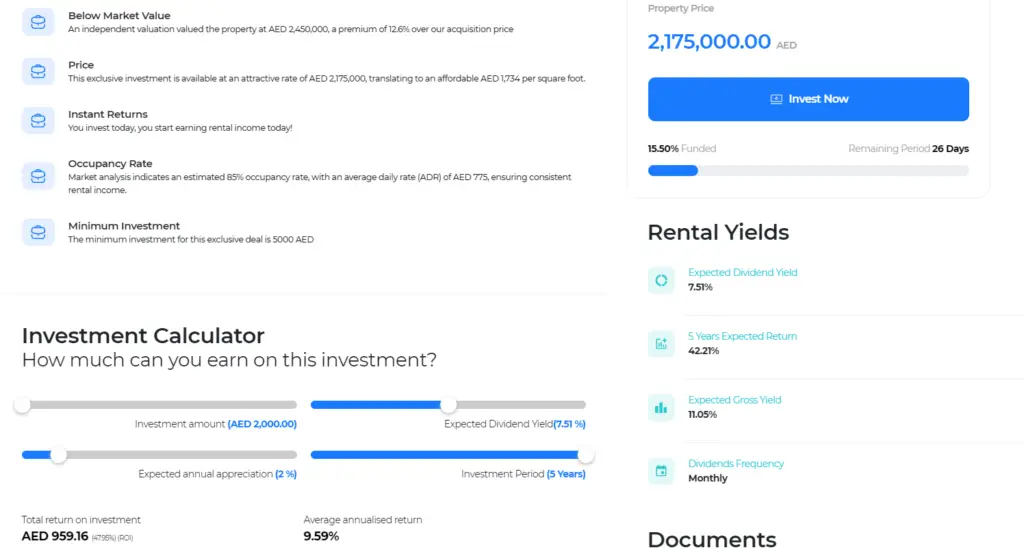

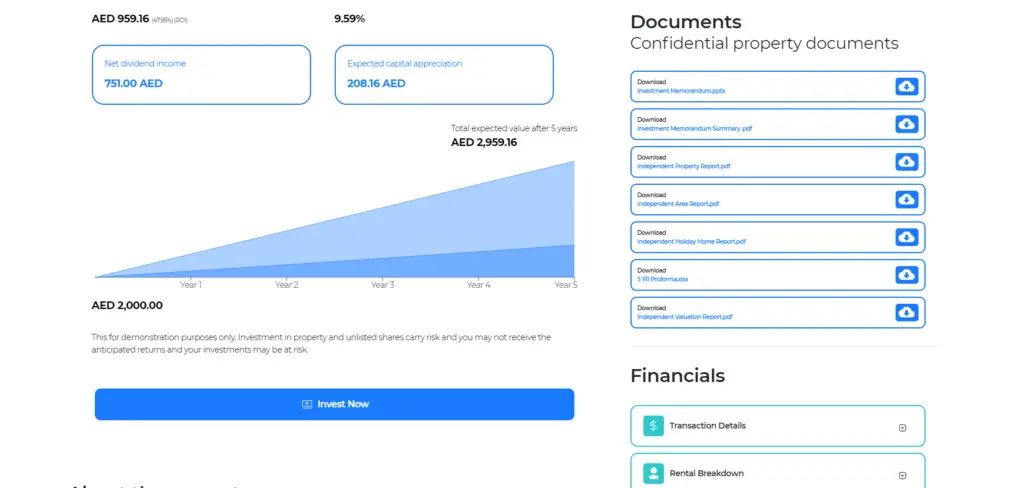

III. Investment Calculator and Rental Yields

IV. Important Documents and Financials

SmartCrowd boasts a user-friendly interface that simplifies the investment process. The platform’s intuitive design allows users to easily browse investment opportunities, access property details, and review financial projections. The navigation is straightforward, enabling investors to track their investments, view transaction history, and monitor their portfolio performance conveniently.

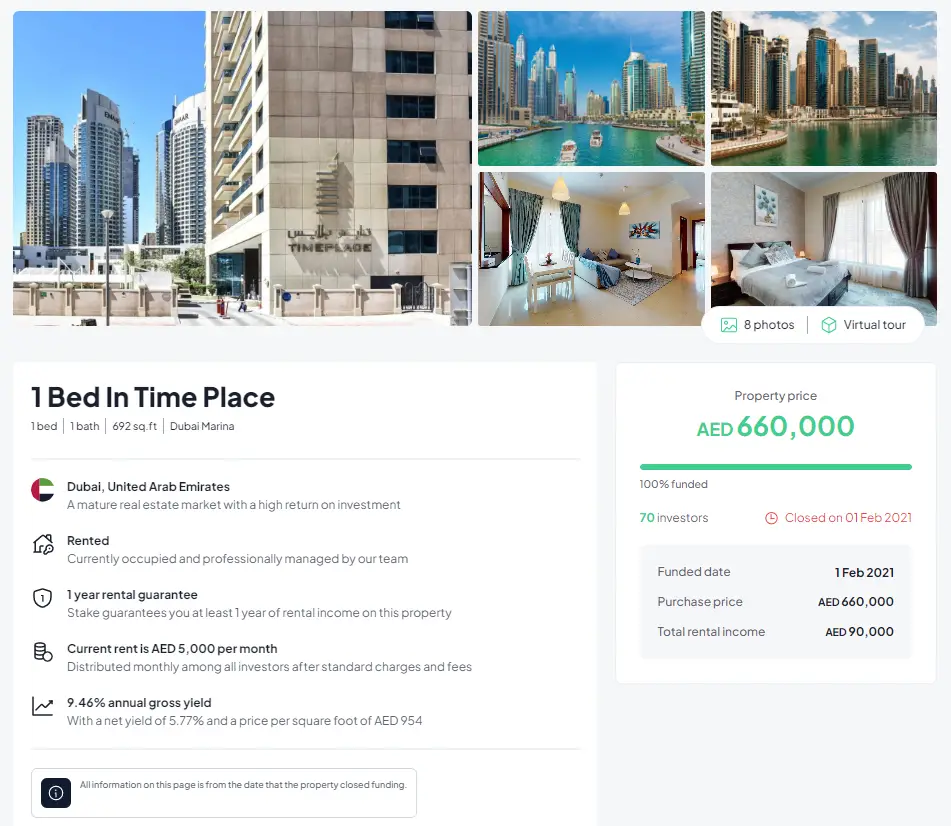

STAKE

I. Property Overview

II. Investment Calculator and Financials

III. Documents

Stake also emphasizes a user-friendly interface that facilitates an efficient investment experience. The platform focuses on providing investors with a clean and intuitive layout, allowing easy exploration of investment opportunities and property information. Stake’s navigation system is designed to streamline the investment process, providing quick access to essential features and account management tools.

Mobile App Availability and Functionality

Both SmartCrowd and Stake offers a dedicated mobile app for both iOS and Android platforms. Their mobile app provides users with on-the-go access to their investments, enabling them to browse, invest, and monitor their portfolios conveniently. It is designed to offer a seamless and optimized experience, allowing investors to stay updated and make investment decisions whenever and wherever they choose.

User Reviews and Ratings

User reviews and ratings of SmartCrowd generally highlight positive experiences with the platform’s user interface, ease of use, and customer support. Investors often appreciate the platform’s transparency, timely updates, and accessibility of investment details. However, some users have occasionally mentioned there is room for improvement on their platform and also delays in their account being activated, although these instances are typically infrequent.

User reviews and ratings for Stake also reflect positive feedback on the user experience. Investors often appreciate the platform’s intuitive design, ease of navigation, and the ability to browse and invest in projects seamlessly. The majority of users report positive interactions with customer support, indicating responsive assistance when needed.

Transparency and Due Diligence

Transparency and due diligence are crucial factors to consider when evaluating real estate crowdfunding platforms like SmartCrowd and Stake.

In this section, we will examine the transparency of investment details and property information provided by each platform, as well as the processes they employ for due diligence.

Transparency of investment details and property information on SmartCrowd

SmartCrowd places a strong emphasis on transparency, providing investors with comprehensive information about investment opportunities. The platform offers detailed property descriptions, including location, property type, size, amenities, and potential returns. Investors can access key financials, such as projected cash flows, net dividend income (rent yields) , expected gross yields , estimated capital appreciation and the 5 year expected return. SmartCrowd

In addition to property details, SmartCrowd presents confidential property documents about the property such as Investment Memorandum, Independent Area Report, and the Monthly Transaction Report . This transparency allows investors to assess the expertise and track record of the individual report behind the projects.

Moreover, SmartCrowd discloses the investment structure, providing clarity on ownership rights, profit distribution, and potential exit strategies. Investors can review the legal documents, such as operating agreements and subscription agreements, ensuring transparency and alignment of interests.

Transparency of investment details and property information on Stake

Similar to SmartCrowd, Stake strives to maintain a high level of transparency in providing investment details and property information. Investors can access comprehensive property descriptions, including location, size, lease terms, and potential returns. Stake also provides financial projections, rental income estimates, and market analysis to help investors make informed decisions.

Additionally, Stake highlights the track record and experience of the project sponsors or development teams associated with each investment opportunity. This transparency enables investors to assess the credibility and expertise of the parties involved.

Furthermore, Investors can review the necessary documents, such as valuation reports and partnership agreements, to understand the terms and conditions of their investments along with the financials such as acquisition cost, forecasted cash flows and returns

Evaluation of due diligence processes

Both SmartCrowd and Stake employ rigorous due diligence processes to assess investment opportunities and mitigate risks.

SmartCrowd conducts thorough property vetting, which includes market analysis, property inspections, and financial analysis. They aim to select properties with strong potential for rental income, capital appreciation, and market demand. The platform uses 100-point proprietary screening tool and real-time market data provided by REIDIN to assess various factors, such as location, property condition, tenant profiles, and local market trends.

Furthermore, SmartCrowd collaborates with property brokers, financial institutions, and independent consultants to source the most suitable properties for its users. It is worth noting that in certain instances, SmartCrowd may receive a stipend from these property brokers. To address any potential conflict of interest, SmartCrowd has implemented a policy of transparent disclosure. They ensure that the details regarding such conflicts of interest are fully disclosed to investors.

Similarly, Stake carries out comprehensive due diligence on potential investments. Their team analyzes market conditions, conducts property inspections, and evaluates the financial feasibility of projects. They also assess the credibility and past performance of the development team or project sponsors.

Both platforms collaborate with external professionals, such as legal advisors and property valuation experts, to ensure the accuracy and reliability of their due diligence processes.

By conducting rigorous due diligence, SmartCrowd and Stake strive to provide investors with carefully vetted investment opportunities and enhance investor confidence.

Overall, both SmartCrowd and Stake demonstrate a commitment to transparency by providing detailed investment information, property data, and clear documentation. Their rigorous due diligence processes further support the reliability and quality of the investment opportunities presented on their platforms. Investors can confidently assess the information provided by each platform to make well-informed investment decisions.

Real Estate Investment Options

SmartCrowd offers two investment options:

HOLD is a long-term investment strategy where investors can buy a portion of a property and hold onto it for an extended period. The goal of this strategy is to generate steady rental income over time and benefit from any appreciation in the property’s value. HOLD investments on SmartCrowd typically require a minimum investment period of two years.

FLIP, on the other hand, is a short-term investment strategy where investors can buy a portion of a property and sell it within a short period for a profit. The goal of this strategy is to benefit from the appreciation of the property’s value in a short period. FLIP investments on SmartCrowd typically require a minimum investment period of six months.

Stake recommends and strictly enforces on investment option:

Long-term commitment – Stake recommends that investors have a horizon of at least five years, as the best returns on real estate are typically generated over time through rental income (yield) and asset appreciation (capital appreciation).

Analysis of the Profitability and Returns

SmartCrowd Investment Returns: What to Expect

In the previous sections, we’ve gone through the investment options and assets offered by SmartCrowd, along with the fees involved. Now, let’s dive into what you really want to know: the returns.

SmartCrowd offers attractive investment returns for both the HOLD and FLIP options. With the HOLD option, investors can expect steady rental income and capital appreciation over the long-term. On the other hand, the FLIP option offers investors the opportunity to earn short-term capital gains by buying and selling properties quickly.

In both cases, SmartCrowd carefully selects and manages properties to ensure maximum returns for investors. In this section, we’ll provide you with a detailed breakdown of the expected returns when investing with SmartCrowd.

A property that is valued 1 million AED and you the investors, invest 1000AED. You would own 1000 shares 0.1% of the property. Generally, rental income is calculated as a percentage of the total property value, with a typical range of 3-10% annually. Therefore, your monthly rental income could be anywhere from a few hundred to several thousand AED per month. It’s important to note that rental income is not guaranteed and may fluctuate based on market conditions and property management.

SmartCrowd provides predictions on the percentage of appreciation your investment may experience. For instance, if SmartCrowd predicts a 2% annual appreciation on a property worth 1 million AED, and you invest 1000 AED, the property’s value would be worth 1,104,080 AED after 5 years. As a result, your initial investment of 1000 AED would be worth approximately 22,081 AED at the end of the 5-year period. It’s important to note that these are projections, and the actual returns may vary based on a variety of factors.

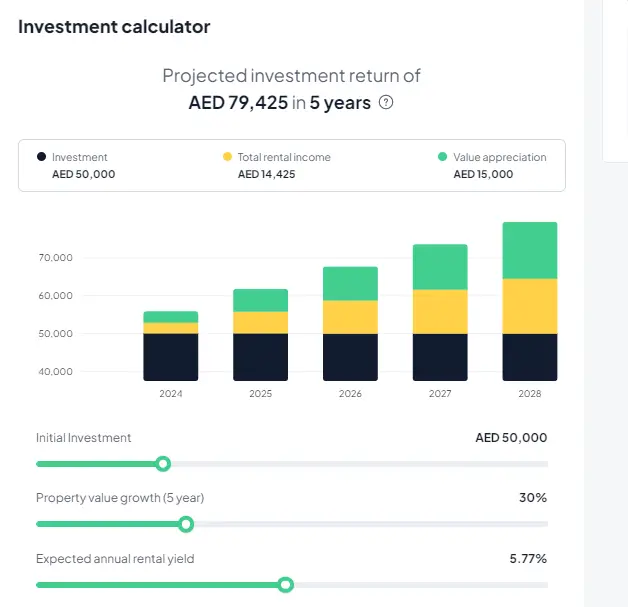

Stake Investment Returns: What to Expect

Stake offers investment opportunities in real estate assets, which have the potential to generate returns in two ways: rental income and capital appreciation. Rental income is the recurring income generated from leasing the property to tenants. Capital appreciation refers to the increase in the value of the property over time, which can be realized when the property is sold.

Investors can expect to receive regular rental income distributions, typically on a quarterly basis, throughout the investment term. The exact amount of rental income will depend on the specific property and the rental rates in the local market. For example, if an investor invests in a property worth AED 1 million that has a gross rental yield of 6%, they can expect to receive AED 60,000 in rental income per year or AED 5,000 per month.

Capital appreciation, on the other hand, is dependent on various factors such as the local real estate market conditions, demand and supply dynamics, and macroeconomic factors such as interest rates and inflation. However, over the long-term, real estate assets tend to appreciate in value, and investors can potentially realize significant capital gains when the property is sold.

Stake offers investment opportunities with varying expected returns, ranging from 8% to 12% per annum. These returns are based on a combination of rental income and capital appreciation, and may vary depending on the specific property and investment term. For example, an investment in a property with a 10% expected annual return and a 5-year investment term, with an initial investment of AED 100,000, would yield a total return of AED 161,051, including AED 50,000 in rental income and AED 11,051 in capital appreciation.

Recommendations Based on Investor Profiles and Preferences

When choosing between SmartCrowd and Stake, investors should consider their unique profiles and preferences. Here are some recommendations based on different investor profiles:

- Investment Horizon: SmartCrowd advises investors to maintain their investments for at least 5 years, primarily targeting long-term goals. However, they also offer support for investors looking to achieve their short-term objectives. SmartCrowd provides educational resources and guidance on various exit strategies that can be employed when necessary. On the contrary, Stake strongly emphasizes a long-term commitment, recommending investors to hold their investments for a period of at least five years.

- User Experience and Interface: Both SmartCrowd and Stake provide a user-friendly experience, but investors may have personal preferences based on the platform’s interface, navigation, and mobile app availability. It is recommended to explore the platforms’ interfaces and test their user experience before making a final decision.

- Fees and Costs: Evaluating the fee structures is essential for investors. SmartCrowd and Stake have their respective fee systems, including management fees, transaction fees, and other costs associated with the investment process. It is important for investors to carefully consider and compare these fees to assess their potential impact on investment returns.

Final verdict: Which platform is the best fit for you?

Selecting the ideal real estate crowdfunding platform is a subjective decision that hinges on the unique needs and preferences of individual investors. Numerous factors come into play, including investment options, user experience, fees, and personal inclinations. It is crucial for real estate investors to conduct thorough research, analyze investment strategies, and even seek professional advice to arrive at an informed choice.

In our view, the key distinguishing factor between SmartCrowd and Stake lies in the type of investor one is. If you are not a committed long-term investor, Stake may not align well with your preferences, whereas SmartCrowd could be a more suitable option. To best familiarize yourself with and test out each platform, you can utilize our links above, which offer a bonus of $250 AED (for investment purposes) when you sign up and get approved.